Bitcoin drops to $76k after Trump fails to rule out a recession

Ether dropped 9%, XRP fell 2%, and Dogecoin lost over 8% in 24 hours

Investors react to Trump’s comments about a possible recession

The US stock market lost more than $1.7 trillion in value

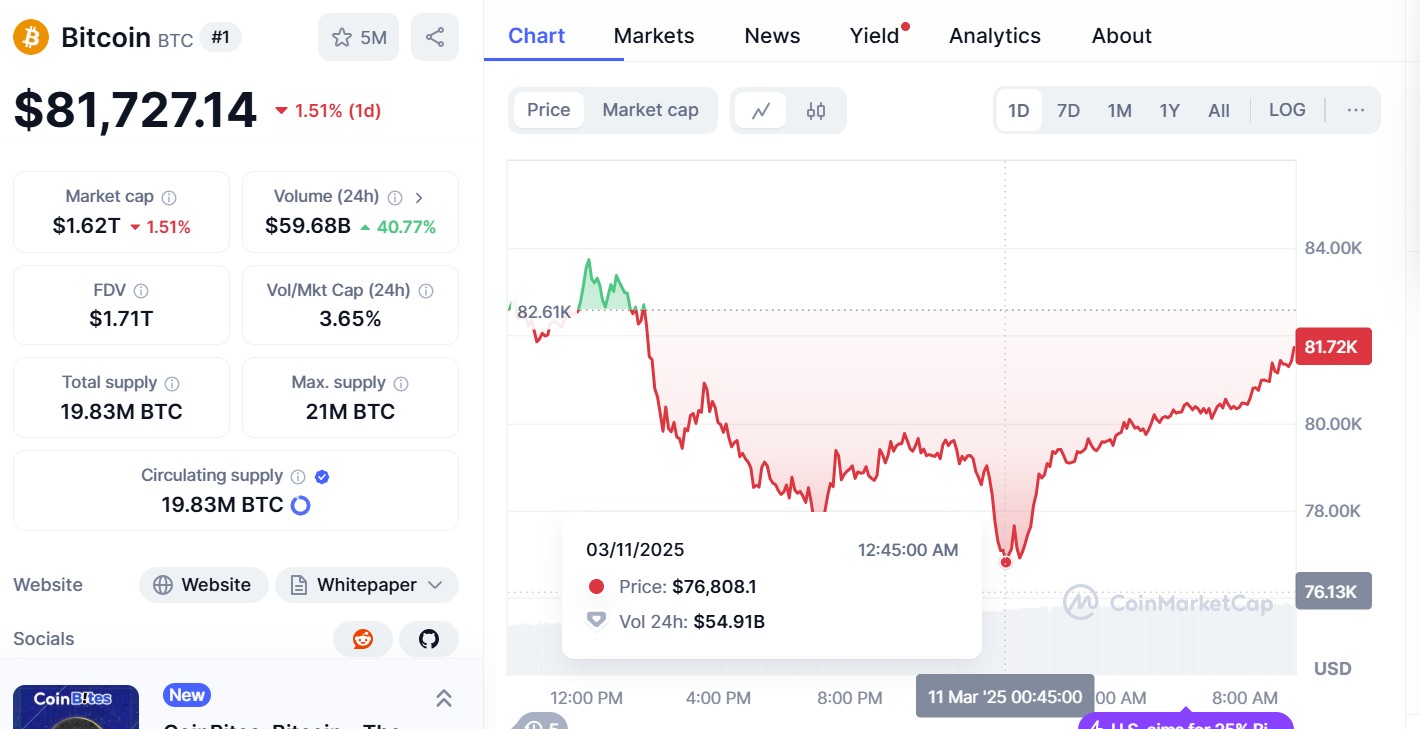

Crypto prices have fallen across the board, with Bitcoin dropping below $77,000 as investors continued to react to US President Donald Trump’s tariff policies and the Bitcoin reserve plan.

In the early hours of Tuesday, March 11, Bitcoin fell to $76,000, a figure not seen since last September. In a post on X, crypto trader Ali said:

“If #Bitcoin $BTC holds $80,000, the bull case remains strong. Losing this level, however, could put $69,000 in play as the next key support!”

If #Bitcoin $BTC holds $80,000, the bull case remains strong. Losing this level, however, could put $69,000 in play as the next key support! pic.twitter.com/PuqTrgKF0j

— Ali (@ali_charts) March 11, 2025

Bitcoin has risen slightly and is back up around $81,600 at the time of publishing, according to CoinMarketCap. Ether, on the other hand, was down over 9% in 24 hours to $1,920, XRP had fallen more than 2%, at $2.13, and Dogecoin was down over 8.81% to $0.1607.

The market reacts

News of the continued market sell-off comes as investors react to Trump’s trade tariffs, the announcement of the US Strategic Bitcoin Reserve, and the possibility of a recession.

Following Trump’s remarks, the US stock market lost more than $1.7 trillion in value yesterday. Elon Musk’s Tesla saw its shares drop by at least 15% to $222, losing over half its value from its December peak at $479.86. In a post on X, Musk said: “it will be fine long-term.”

Market conditions haven’t been helped by Trump’s trade tariffs on Canada, China, and Mexico. Last month, it was confirmed that Trump was imposing a 25% trade tariff on Canada and Mexico; however, this has been delayed until April 2. China had a 20% tariff levied against it.

BitMEX co-founder Arthur Hayes took to X to ask people to be “patient.”

“$BTC likely bottoms around $70k. 36% correction from $110k ATH, v normal for a bull market,” adding:

“Traders will try to buy the dip, if you are more risk averse wait for the central banks to ease then deploy more capital. You might not catch the bottom but you also won’t have to mentally suffer through a long period of sideways and potential unrealised losses.”